Savvy share market investing

With markets up one day and down the next, it can be difficult to feel comfortable about investing in shares. Here are five savvy strategies to help you manage your portfolio:

1. Don’t miss the rebound

When we look back, after every share market fall we’ve seen an eventual rebound. By keeping your money in cash and waiting for the “perfect time” to return to the market, you risk missing out. Why? Because some of the best days for share market gains are during share market rebounds. Missing out on these gains can make a big difference to your overall return.

Let’s take a look at an example. If you had $10,000 invested in the Australian share market for the last 20 years, your investment would have grown to $66,583, as at April 2013. If you’d missed out on the 10 best days, you would only have $41,589[1].

2. Invest across industries

It’s important to remember that different industries and companies may perform well or poorly, depending on the economic cycle.

Types of industries that do well in downturns include healthcare, telecommunications and utilities such as electricity and gas companies. That’s because even when the economy is weak, people still buy the essential products and services of companies in these industries.

Meanwhile industries such as electronics, automotives and luxury goods tend to do well when the economy is strong because people are more likely to spend on non-essentials and items they may have delayed buying when times were tougher.

By diversifying your share portfolio across companies from different industries you’re more likely to have some companies in your portfolio performing well when others are weak. This diversification can help smooth your returns. And, you’re less exposed to the fortunes or failures of any one company.

3. Go global

Australia makes up only 3% of the global share market, with our domestic market dominated by resources and financials. It’s easy to forget and ignore investment opportunities found offshore. If you’re looking to diversify and take advantage of growth opportunities for your portfolio, it’s important to consider global shares. Some of the largest, most innovative and profitable companies originate from the US, Europe, Asia and emerging economies. Think about brands you use every day:

-

Google

-

Apple

-

Toyota

-

Nestle, to name just a few

By investing with an active fund manager, you can get access to these types of companies. You’ll also benefit from the fund manager’s in-depth knowledge of foreign sharemarkets and companies

4. Get income

Most people think of share performance in terms of growth or reduction in a company’s share price. It’s easy to forget the share price is only one part of a share’s overall return. The other part is the income received from dividends.

While it’s important to remember that dividends from shares aren’t guaranteed, dividends paid by companies can provide a healthy source of income. In mid 2013, the average dividend yield of the Australian share market was around 4.3% pa and some companies offered yields of around 7% to 8% pa or higher.

5. Start a regular investment strategy

We only ever know the perfect time to invest after it’s happened. One idea is to start slowly and invest small amounts in a managed share fund at regular intervals. This strategy, called dollar cost averaging, has the following benefits:

-

It helps you benefit from short-term market volatility. You’ll buy fewer units when the market is up (and prices are high) and more units when the market is down (and prices are low).

-

You can end up owning more units over time than if you make a one off, lump sum investment.

-

It takes the guesswork out of deciding when to get back into the market.

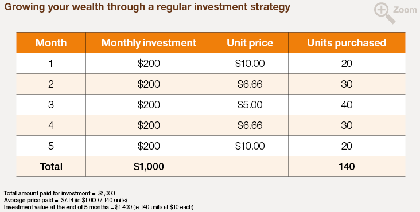

This table demonstrates how it works. A person has $1,000 to invest. In this example, the price for an investment unit starts at $10, then falls and rises back to $10 at the end of the five months. By investing $200 each month for five months, the investor has 140 units valued at $1,400 in the end. If the investor had invested $1,000 in a lump sum at the beginning or at the end of the five months, they would only have 100 units, valued at $1,000.

Things to remember

-

After major sharemarket falls, we’ve always seen a recovery.

-

Staying invested in the sharemarket means you won’t miss any rebound/recovery.

-

Shares can provide you with capital growth and income.

-

Diversifying across different industries and countries can help to smooth returns and maximise growth opportunities.

-

Dollar cost averaging can help you get back into the market or remain invested without risking a large sum of money upfront.